nebraska sales tax rate changes

Nebraska has recent rate changes Thu Jul 01 2021. The current state sales tax rate in Nebraska NE is 55 percent.

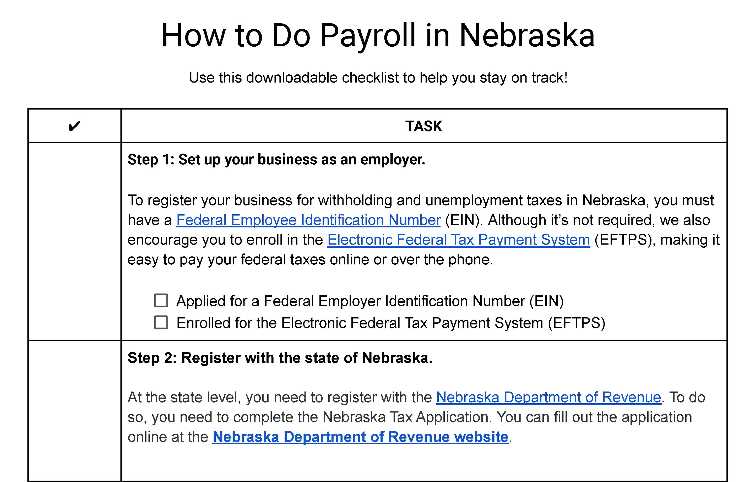

How To Do Payroll In Nebraska What Every Employer Needs To Know

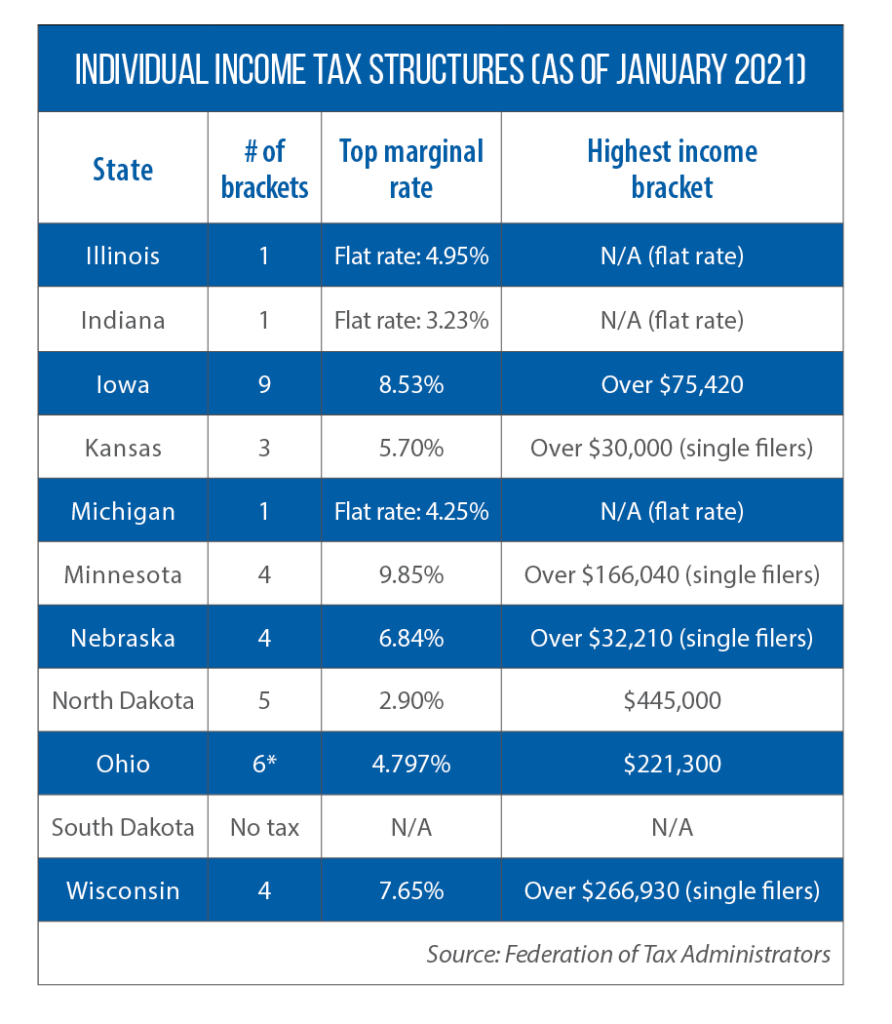

LB 873 reduces the maximum tax rate of 684 for the income tax imposed on individuals and fiduciaries for taxable years beginning on or after January 1 2023.

. A new 1 local sales and use tax takes effect bringing the combined rate to 65. Counties and cities can charge an. Nebraska Department of Revenue.

April 2019 sales tax changes. The state sales tax rate in Nebraska is 5500. Sales Tax Rate Finder.

Tax Rate Starting Price. Average Sales Tax With Local. Request a Business Tax Payment Plan.

Changes in Local Sales and Use Tax Rates Effective January 1 2021. Base State Sales Tax Rate. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

The Nebraska state sales and use tax rate is 55 055. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

The 55 sales tax rate in Nemaha consists of 55 Nebraska state sales tax. Groceries are exempt from the Nebraska sales tax. Sales and Use Tax.

The Nebraska NE state sales tax rate is currently 55. This study recommended that business-to-business sales or business inputs be exempt a structural principle that still exists in todays law that is supported by economists as. The maximum tax rate for.

Beginning October 1 2002 Nebraska will have several alterations to their sales and use tax system. Local Sales Tax Range. The base state sales tax rate in Nebraska is 55.

With local taxes the total sales tax rate is between 5500 and 8000. There is no applicable county tax city tax or special tax. 800-742-7474 NE and IA.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Make a Payment Only. Find your Nebraska combined state.

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. The Nebraska state sales and use tax rate is 55.

Local sales and use tax increases to 2 bringing. The sales tax rate was originally going to be 55 up from 5 from October 1. 22 rows Over the past year there have been 22 local sales tax rate changes in Nebraska.

18 rows Local sales and use tax rate changes have been announced for Nebraska effective October. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. 2 lower than the maximum sales tax in NE.

Combined Sales Tax Range.

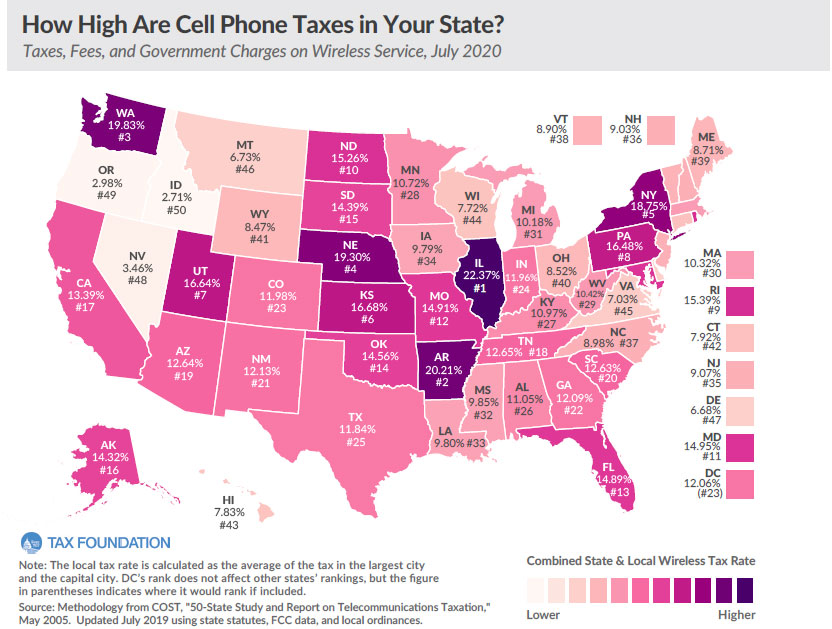

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

With Revenue Growth Strong Iowa Nebraska Ohio And Wisconsin Legislatures Cut Income Taxes In 2021 Csg Midwest Csg Midwest

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

How Do State Estate And Inheritance Taxes Work Tax Policy Center

A Twenty First Century Tax Code For Nebraska Tax Foundation

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

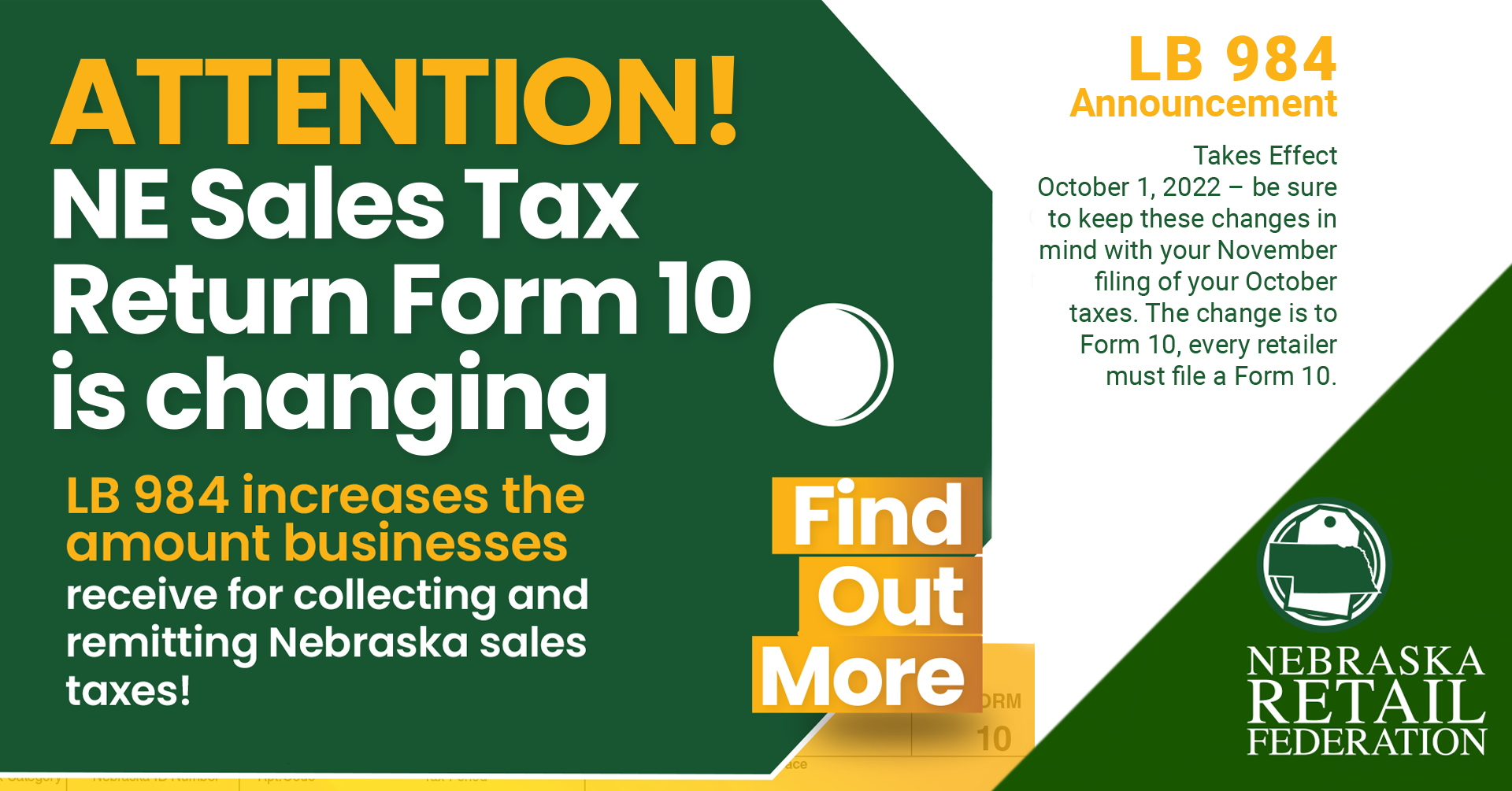

Nebraska Retail Federation Nebraska Retail Federation

State Individual Income Tax Rates And Brackets Tax Foundation

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

General Fund Receipts Nebraska Department Of Revenue

The Johnson County Kansas Local Sales Tax Rate Is A Minimum Of 7 975